Claim your pension from abroad using the same form with which you claim your pension from Finland. State on the form from which country you are claiming the pension. Get started by clicking the button “Log in”. You will be forwarded to your own pension provider’s claim service.

Log in to the pension application service

You can also claim your pension by filling out a paper form or by filling out and printing an online form (both available also in English).

Go to claim forms and claim instructions

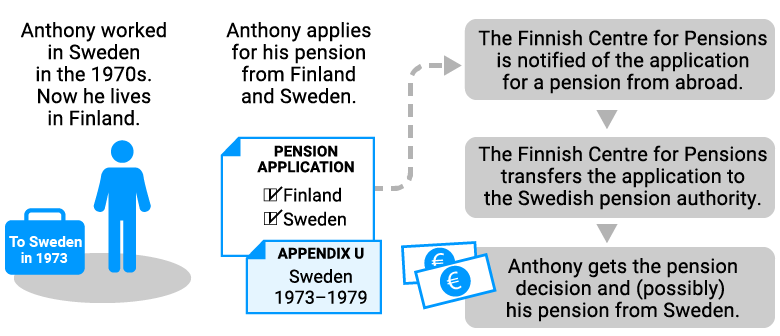

You must attach information on your work and living abroad to your claim form. If you are claiming your pension via an online claim service, you will get the instructions on how to provide that information via the online service. If you fill out a paper form, attach Appendix U (form 7110e) to your claim.

You can submit your pension claim to an earnings-related pension provider, Kela or the Finnish Centre for Pensions. The Finnish Centre for Pensions will forward your claim to the foreign country.

The foreign pension provider will issue its pension decision in its own national language and send it to your home address. It will also pay your pension directly to your bank account.

Separate claim form for social security agreement countries

When you claim a pension from a social security agreement country, you have to fill in a separate claim form that is in line with the social security agreement.

If you have stated on your claim form for a Finnish pension that you are also claiming a pension from a social security agreement country, the Finnish Centre for Pensions will send you instructions and a claim form in line with the social security agreement. To speed up the handling of your claim you can print out the forms yourself.

Go to social security agreement countries’ pension claim forms

Once you have filled in the claim form that is in line with the social security agreement, send it to the Finnish Centre for Pensions. The Finnish Centre for Pensions will confirm certain data on the form to the pension provider of the social security agreement country. Finally, the Finnish Centre for Pensions will transmit your claim to the pension provider of the country in question. That pension provider will process your pension claim.

Claim your pension in time

It takes longer to process a pension claim abroad than in Finland. The processing time is affected by, for example, what type of pension you are claiming and from which country.

Claim an old-age pension 6-9 months before the date on which you wish the pension to begin. At the very latest, you must submit your claim during the month in which you intend your pension from abroad to begin.

For more detailed information on the processing times, contact the pension authorities of the country in question. Contact the Finnish Centre for Pensions for contact information if necessary.

Getting the Finnish pension decision may also take longer than usual if your pension provider needs information on work you have done abroad (that is, your insurance periods from abroad) for its pension calculations. For more information, contact your pension provider.

Fill in Appendix U carefully

Fill in Appendix U carefully, as the information you provide will form the basis for establishing your right to a pension abroad. It is important that you include information on all work that you have done abroad and any periods during which you have lived abroad, even if you are not claiming a pension from all of the countries you have lived and/or worked in.

Whenever possible, enclose copies of your work references, employment records and pay slips that relate to your work abroad.

Enclose also your foreign ID number or policy number, if you have one. At the bottom of this page you find more information on how the documents should be authenticated.

Foreign pension provider may contact you

Your foreign pension provider will establish your right to a pension from abroad. In the process, it may send you questions relating to your work abroad, your living arrangements abroad, or your income abroad or in Finland.

The questions are usually sent in the official language of the foreign country. If it is an EU country, you have the right to answer your foreign pension provider in any of EU’s official languages. You can reply to inquiries from a social security agreement country either in the official languages of the country in question. If you fail to answer the questions, the foreign pension provider may reject your claim.

The Finnish pension record does not include data on the pension you have earned abroad. The Finnish Centre for Pensions does not have that information, either.

If you ask, your foreign pension provider may give you an estimate of your future pension from that country. Some of them send you the pension estimate automatically at regular intervals, if they know your address. Sometimes it can be very difficult to get a pension estimate from another country. You may need banking credentials or other individual online banking ID codes for that country to get a pension estimate.

In some countries, you may not get a pension estimate until 1-2 years before the country’s general retirement age.

To get a pension estimate from abroad, you may have to contact the foreign pension provider personally. The easiest and often only way to ask for an estimate is to do it in writing. Some pension providers may send you the estimate on paper. Others may send you an individual code or a username and password with which you can check your pension estimate via a service on their website.

When you ask for a pension estimate, include at least the following information in your letter:

- your name (also previous names),

- your date of birth,

- your current address in Finland,

- your places of work and times of work abroad (also the addresses, if you know them) ,

- your foreign insurance number of ID number (if you know it), and

- the name of the pension system under which you have been insured (if you know it).

Non-agreement countries are countries other than EU/EEA countries and countries with which Finland has a social security agreement.

The Finnish Centre for Pensions does not forward pension claims to non-agreement countries. Instead, you have to sort out your right to a pension from such a country and claim that pension on your own.

Note that not all non-agreement countries pay pensions abroad.

Go to the website of the International Social Security Association (ISSA) for the contact information of pension providers in non-agreement countries and countries outside the EU/EEA.

Statutory pensions are topped up with supplementary and contract-based pensions in many countries.

As a rule,the Finnish Centre for Pensions does not transmit pension claims for such pensions abroad since they tend not to be covered by the EU regulation on social security or the bilateral social security agreements.

You can to contact the pension provider with whom you are insured for a supplementary or contract-based pension yourself to find out if or when you have the right to these pensions.

For more information, go to the page Additional information on pensions from abroad.

Many East and South European countries require that you submit a copy of employment records when you claim a pension from them. As a rule, you do not have to submit the original documents, but the copies have to be authenticated.

To attach authenticated copies of your documents to a claim to an EU/EEA or agreement country, do one of the following:

- Send the original documents by post to the Finnish Centre for Pensions. The Finnish Centre for Pensions will make authenticated copies of them and send the copies abroad. It will return the original documents to you once the claim has been processed.

- Present the original documents to an official at a Kela office. The Kela official will take copies of them and authenticate the copies. The official will then send the authenticated copies to the Finnish Centre for Pensions. The Finnish Centre for Pensions will send them abroad.

If you are displeased with the pension decision a foreign pension provider has issued, you can appeal the decision. Follow the appeal instructions that came with the pension decision. Make sure to send in your appeal within the time limit stated in the pension decision.

Send your appeal to the pension provider who issued your decision or to the address stated in the pension decision. You can also send your appeal to the Finnish Centre for Pensions, Kela or your own pension provider. They will transmit your appeal abroad. Note that if you send your appeal to one of these authorities in Finland, your appeal may take longer to process. Once you have submitted your appeal, call the institution to submitted it to to make sure that it is forwarded abroad as soon as possible. The quickest way to get your appeal processed is to send it abroad yourself.

You can write your appeal in any of the official EU languages, including English. If you write your appeal in the official language of the country that issued the decision, your appeal may be processed faster. You can appeal a decision from a social security agreement country in the official languages of the country (or in English).

Provide at least the following information in your appeal:

- the decision that you are appealing,

- the particular point that you would like to have changed,

- grounds for your appeal (how you would like the decision to be changed, that is, what is wrong or lacking in the decision),

- your own contact information (name, address, telephone number, personal ID or insurance number in the country that issued the decision), and

- date and signature.

When you have received a pension decision from all EU/EEA countries from which you have claimed a pension, you can check how they together affect your pension rights. Even if each country grants or rejects your pension claim based on their national pension laws, the pension provider issuing the decision must take into account the rules of the EU social security regulations. For more detailed information on the content of issued pension decisions and the grounds on which pensions are granted, contact the pension provider that issued your pension decision.

If you think that the pension decision issued by two or more pension providers have a negative effect on your right to a pension in two or more EU/EEA countries, contact the institutions that have issued the decisions and ask them to check their decisions. In that case, contact the Finnish Centre for Pensions and ask them for a summary of your EU decisions (form P1).

Once you have got the summary from the Finnish Centre for Pensions you can ask the institution that issued your pension decision to check its decision. Send your request within the time limit stated on the summary (or the pension decision). The time limit may be different in different countries.

If it’s an older claim, the summary of the EU pension decisions will be issued on an older version of the form (E211). After you have got the summary on form E211, you can appeal pension decisions which you have not been allowed to appeal before.