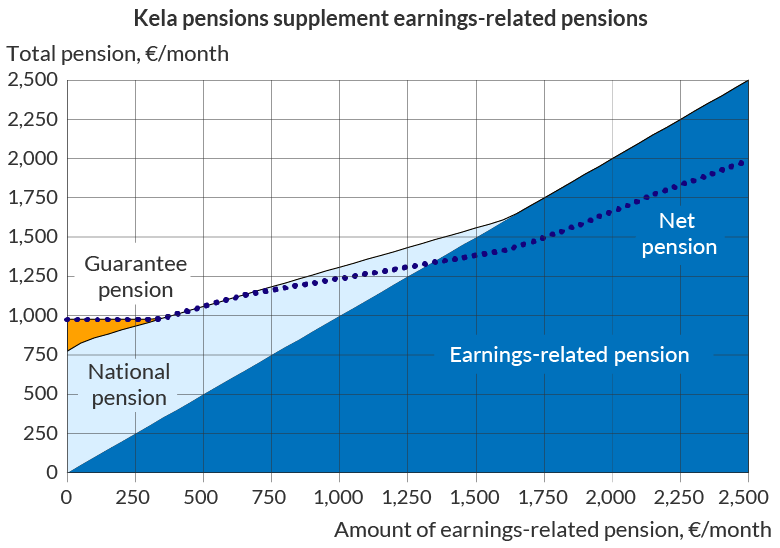

For the majority of retirees living in Finland, the earnings-related pension is the main source of income. The pension can consist of different components: the earnings-related pension, the national pension, the guarantee pension and a pension from abroad.

National pension

If you have earned no or only a small earnings-related pension, you may get a national pension paid out by Kela. Kela pays both disability and old-age pensions. To get a national pension, you have to be covered by Finnish social security. You must also live or have lived in Finland for at least 3 years since your 16th birthday.

The national pension is reduced as your earnings-related pension grows. When the earnings-related pension reaches a certain level the national pension is no longer granted.

The tables at the end of this page show examples of how the total pension is built up. The first table is for single pensioners and the other for pensioners who live with their spouse.

The national pension is payable at its full amount only if you receive no earnings-related pensions or if their combined amount before taxes is 66.29 euros per month or less (2025).

Read more about old-age pension in the form of a national pension on Kela’s website

Guarantee pension

The guarantee pension paid out by Kela offers you a minimum pension if your total monthly pension before tax is less than 978.34 euros (in 2025). The income limit and the minimum pension is lower if you have retired early on an old-age pension.

All other pensions that you receive in Finland and from abroad affect the amount of the guarantee pension that you may receive. As for earnings-related pensions, any old-age, disability, years-of-service and survivor’s pension you may receive under the earnings-related pension system affect the amount of your guarantee pension.

You will get the full guarantee pension of €986.30 (2025) only if you do not receive any other pensions.

Read more about who may qualify for a guarantee pension on Kela’s website

Total pension: Examples of national and guarantee pensions

In the following examples, the national pension and the guarantee pension have been calculated under the assumption that all earnings-related pension income reduces the national pension.

The earnings-related pension has been adjusted with the life expectancy coefficient. The total pension is combined earnings-related, national and guarantee pensions that they receive per month. Taxes have been calculated assuming that the person’s monthly income has been of the same amount throughout the year.

Example table: Single pensioner at age 65 in 2025

| Earnings-related pension e/month | National pension e/month | Guarantee pension e/month | Total pension e/month | Net pension e/month | Taxes and contributions e/month | Taxes and contributions % of gross pension |

|---|---|---|---|---|---|---|

| 0 | 783 | 203 | 986 | 986 | 0 | 0.0 |

| 100 | 767 | 120 | 986 | 986 | 0 | 0.0 |

| 200 | 717 | 70 | 986 | 986 | 0 | 0.0 |

| 300 | 667 | 20 | 986 | 986 | 0 | 0.0 |

| 400 | 617 | 0 | 1017 | 1017 | 0 | 0.0 |

| 500 | 567 | 0 | 1067 | 1067 | 0 | 0.0 |

| 600 | 517 | 0 | 1117 | 1117 | 0 | 0.0 |

| 700 | 467 | 0 | 1167 | 1159 | 8 | 0.7 |

| 800 | 417 | 0 | 1217 | 1189 | 27 | 2.2 |

| 900 | 367 | 0 | 1267 | 1220 | 46 | 3.7 |

| 1000 | 317 | 0 | 1317 | 1250 | 67 | 5.1 |

| 1100 | 267 | 0 | 1367 | 1279 | 88 | 6.4 |

| 1200 | 217 | 0 | 1417 | 1309 | 108 | 7.6 |

| 1300 | 167 | 0 | 1467 | 1338 | 129 | 8.8 |

| 1400 | 117 | 0 | 1517 | 1367 | 149 | 9.8 |

| 1500 | 67 | 0 | 1567 | 1397 | 170 | 10.8 |

| 1800 | 0 | 0 | 1800 | 1535 | 265 | 14.7 |

| 2100 | 0 | 0 | 2100 | 1737 | 363 | 17.3 |

| 2400 | 0 | 0 | 2400 | 1928 | 472 | 19.7 |

| 3000 | 0 | 0 | 3000 | 2300 | 700 | 23.3 |

| 4000 | 0 | 0 | 4000 | 2827 | 1173 | 29.3 |

Taxes and comparable payments have been calculated according to the final taxation in 2025. The municipal tax rate is 7.54 and the pensioner’s medical care contribution is 1.45. The Church tax rate has been excluded from the calculation. A public service broadcasting tax of 2.50 per cent, or a maximum of 160 euros per year, is levied on the pension. The taxation has been calculated assuming that the person has no other income than the earnings-related, national and guarantee pensions.

Earnings-related pensions also include components which do not reduce the national pension. They in-clude, for example, the increase for late retirement.

National pensions and guarantee pensions drawn before the age of 65 are reduced for early retirement by 0.40 per cent per month taken early.

Example table: Married or cohabiting pensioner at age 65 in 2025

| Earnings-related pension e/month | National pension e/month | Guarantee pension e/month | Total pension e/month | Net pension e/month | Taxes and contributions e/month | Taxes and contributions % of gross pension |

|---|---|---|---|---|---|---|

| 0 | 699 | 287 | 986 | 986 | 0 | 0.0 |

| 100 | 683 | 204 | 986 | 986 | 0 | 0.0 |

| 200 | 633 | 154 | 986 | 986 | 0 | 0.0 |

| 300 | 583 | 104 | 986 | 986 | 0 | 0.0 |

| 400 | 533 | 54 | 986 | 986 | 0 | 0.0 |

| 500 | 483 | 0 | 983 | 983 | 0 | 0.0 |

| 600 | 433 | 0 | 1033 | 1033 | 0 | 0.0 |

| 700 | 383 | 0 | 1083 | 1083 | 0 | 0.0 |

| 800 | 333 | 0 | 1133 | 1133 | 0 | 0.0 |

| 900 | 283 | 0 | 1183 | 1169 | 14 | 1.2 |

| 1000 | 233 | 0 | 1233 | 1199 | 33 | 2.7 |

| 1100 | 183 | 0 | 1283 | 1230 | 53 | 4.1 |

| 1200 | 133 | 0 | 1333 | 1259 | 74 | 5.5 |

| 1300 | 83 | 0 | 1383 | 1288 | 94 | 6.8 |

| 1400 | 33 | 0 | 1433 | 1318 | 115 | 8.0 |

| 1500 | 0 | 0 | 1500 | 1358 | 142 | 9.5 |

| 1800 | 0 | 0 | 1800 | 1535 | 265 | 14.7 |

| 2100 | 0 | 0 | 2100 | 1737 | 363 | 17.3 |

| 2400 | 0 | 0 | 2400 | 1928 | 472 | 19.7 |

| 3000 | 0 | 0 | 3000 | 2300 | 700 | 23.3 |

| 4000 | 0 | 0 | 4000 | 2827 | 1173 | 29.3 |

Taxes and comparable payments have been calculated according to the final taxation in 2025. The municipal tax rate is 7.54 and the pensioner’s medical care contribution is 1.45. The Church tax rate has been excluded from the calculation. A public service broadcasting tax of 2.50 per cent, or a maximum of 160 euros per year, is levied on the pension. The taxation has been calculated assuming that the person has no other income than the earnings-related, national and guarantee pensions.

Earnings-related pensions also include components which do not reduce the national pension. They in-clude, for example, the increase for late retirement.

National pensions and guarantee pensions drawn before the age of 65 are reduced for early retirement by 0.40 per cent per month taken early.