Exceptionally high (6.8%) increase of earnings-related pension index

The Ministry of Social Affairs and Health have confirmed the 2023 indexes for earnings-related pensions. The earnings-related pension index will rise by 6.8 per cent and the wage coefficient by 3.8 per cent compared to 2022. Because of the exceptionally high increase in the earnings-related pension index, the timing of retirement matters if the plan is to retire at the turn of the year 2022-2023.

Due to the rapid rise in prices, the earnings-related pension index will grow clearly more than the wage coefficient at the beginning of 2023.

In 2023, the earnings-related pension index will be 2874, which means an increase of around 6.8 per cent to earnings-related pensions at the turn of the year.

The wage coefficient for 2023 was confirmed at 1.558, an increase of 3.8 per cent year-on-year. At the time of retirement, the wage coefficient adjusts career lifetime earnings to the level of the year in which the pension begins.

Time of retirement makes a financial impact

Because of the exceptionally high increase in the earnings-related pension index, the timing of retirement at the turn of the year 2022-2023 makes a difference.

A person retiring in 2022 will get a higher index increment than a person who retires after the turn of the year (in 2023).

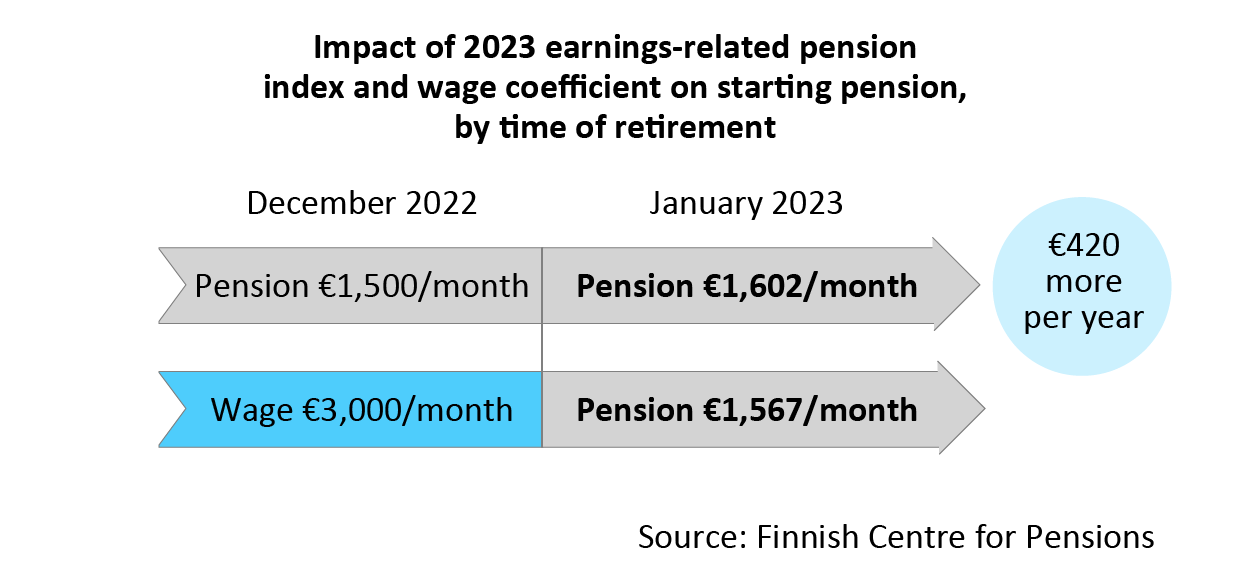

The following example shows the impact of the index when the time of retirement is 2022 or 2023. The index development affects the partial old-age pension, as well. For more examples, go to the website Tyoelake.fi.

Retiring on an old-age pension in December 2022

In this example, a person reaches their retirement age in November 2022 and has accrued a monthly pension of 1,500 euros by the beginning of December 2022. They are not working in retirement.

If they retire on an old-age pension in December 2022, they will get an increment to their pension in January 2023 based on the earnings-related pension index. After this, their monthly old-age pension is 1,602 euros.

Retiring on an old-age pension in January 2023

If a person retires on an old-age pension in January 2023, their previous earnings will be multiplied with the wage coefficient to the 2023 level when their pension amount is calculated.

The size of their earnings-related pension depends on their earnings level before retirement. In this example, we have assumed that the person’s monthly wage is 3,000 euros. This means that their starting monthly old-age pension in January 2023 is 1,567 euros. The person retiring in December 2022 will thus get a monthly pension that is 35 euros higher. Per year, this is around 420 euros more that for the person who retires in January 2023.

Retirement is a huge change in life that should be considered from different viewpoints. Continued working also increases the pension amount due to the increment for late retirement. In addition, the wage received is often clearly higher than the pension. On the other hand, leisure time also has its worth.

For help with planning your retirement, go to your pension provider’s website or contact its customer service.

Claim your old-age pension about one month before you want to retire.

Earnings-related pension indexes

Two indexes affect earnings-related pensions: the earnings-related pension index and the wage coefficient.

- Earnings-related pension indexes adjust pensions in payment to secure their purchasing power.

- At the time of retirement, the wage coefficient adjusts career lifetime earnings to the level of the year in which the pension begins.

The earnings-related pension index puts greater weight on price development while the wage coefficient emphasizes earnings development. Both indexes are adjusted annually in January.

More news